Fashion CEO Agenda 2023: Fashion's tangible pathway to becoming net positive

On the occasion of Global Fashion Summit: Boston Edition 2023, Global Fashion Agenda (GFA) has released the 2023 edition of the Fashion CEO Agenda — a concise report to support the establishment and implementation of leadership strategies to achieve a net positive fashion sector that puts back more into society, the environment, and the global economy than it takes out. In a first for the Fashion CEO Agenda, this edition has been developed to include subsequent action areas for brands, retailers, and producers.

With less than seven years to deliver on the UN’s Sustainable Development Goals, fashion industry leaders, together with the broader sector, must take urgent steps to make sustainability an integral part of their business strategies. Developed for executives of fashion brands, retailers, and producers, the Fashion CEO Agenda is a succinct resource to support executives in accelerating tangible action across five socio-environmental sustainability priorities:

- Respectful and Secure Work Environment

- Better Wage Systems

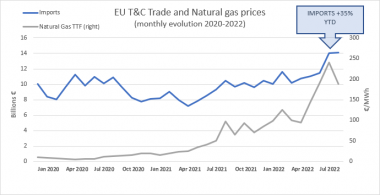

- Resource Stewardship

- Smart Material Choices

- Circular Systems

The 2023 edition includes action areas that have been established through several years of stakeholder engagement and reinforced through the global Fashion Industry Target Consultation, led by GFA in partnership with the United Nations Environment Programme (UNEP). The organisations consulted several hundred industry stakeholders through numerous regional workshops and surveys translated into several languages to help inform a holistic framework that captures global perspectives on social and environmental sustainability.

Action areas outlined in the report include promoting worker access to effective grievance mechanisms, promoting fair compensation and living wages, establishing water stewardship, and addressing overproduction.

Moreover, the report reiterates the need to adopt existing industry-aligned targets, including UNFCCC’s time-bound targets on decarbonisation and the uptake of preferred and low climate impact materials. The material actions outlined are based on consensus across industry stakeholders and topical experts. Extensive stakeholder engagement demonstrated that substantial action is still urgently needed from all actors in the value chain, while such action must be informed by local contexts.

To complement the Fashion CEO Agenda, GFA has created a 2030 Fashion Sector Vision, which presents where the overall sector should be in relation to each of the five sustainability priority areas within only seven years - a critical milestone on the road to net positive by 2050. The objective is to unite the broader sector, consisting of industry actors such as brands, retailers, and producers and other key stakeholders including consumers, citizens, NGOs, innovators, policymakers, and investors. To realise this Vision, it is imperative that the sector moves from ambition to action – the theme underpinning Global Fashion Summit: Boston Edition 2023. GFA now calls on fashion leaders to align their corporate strategies to the priorities and actions laid out in the Fashion CEO Agenda and for the wider sector to support in fostering a conducive environment for scaling this transformation.

Global Fashion Agenda